Land-Based Wind Energy

Economic

Development Guide

Economic Development Guide

A comprehensive resource for community decision makers to better understand the economic development potential during the development, construction, and operation of wind energy projects.

Introduction

Overview

The "Land-Based Wind Energy Economic Development Guide" provides an overview of the local economic impacts of developing, constructing, and operating land-based, utility-scale wind farms. As with any large-scale infrastructure project, there is the potential for economic development because these projects are capital- and labor-intensive. Wind energy projects, however, have many unique opportunities and challenges, which are highlighted in this guide.

This economic development guide is intended to inform county commissioners, local decision makers, economic development corporations, businesses, landowners, and interested community members about economic considerations regarding land-based, utility-scale wind energy. The guide does not provide policy-level guidance or recommendations on the best strategies for economic development. Instead, the guide defines the topic as it relates to wind energy projects, provides insights, and shares community-based examples.

The way a community might experience economic development from wind energy can vary by state, region, and even locality; therefore, communities should consider using this guide as a starting place and then have further discussions with wind project developers and peer communities that have wind development experience.

This guide covers five main topics—wind energy basics, local government revenue sources, community development information, landowner and development considerations, and the business and local workforce—as shown in the following interactive graphic. The combination of all pieces is key to understanding the economic impacts of wind energy.

Economic Development Guide

Understanding the economic impacts of wind energy development projects allows communities to promote opportunities and mitigate challenges. By exploring these five sections of the guide, community leaders can support their residents, collaborate with developers, and make more informed decisions.

About This Guide

The "Land-Based Wind Energy Economic Development Guide" is a WINDExchange resource and tool. WINDExchange is a platform that shares the best-available science and fact-based wind energy information to enable U.S. communities to:

- Make wind development decisions using the suite of WINDExchange resources and tools

- Understand wind energy siting, permitting, and installation processes

- Weigh the costs and benefits of wind energy

- Collaborate or partner with organizations, including nongovernmental organizations, academia, and national laboratories.

WINDExchange is supported by the U.S. Department of Energy’s Wind Energy Technologies Office and facilitated by the National Renewable Energy Laboratory. WINDExchange aims to enable well-informed decisions about the appropriate development of wind energy by providing quality and unbiased information to the public, communities, businesses, organizations, and state and local governments.

Acknowledgments

The U.S. Department of Energy (DOE) Wind Energy Technologies Office WINDExchange program acknowledges the following peer reviewers and organizations whose input and feedback were invaluable to the development of this guide:

- Brett Schwartz (National Association of Development Organizations)

- Eric Bergman (Colorado Counties Inc.)

- Jack Morgan (National Association of Counties)

- Lucas Nelsen (Center for Rural Affairs)

- Lynn Knight (Institute for Sustainable Development)

- Rachel Petry (Southern Power)

- Troy McCue (Lincoln County Economic Development Corporation).

Additional thanks to the following individuals, including DOE for the financial support to create this guide and to DOE staff, the National Renewable Energy Laboratory (NREL), and the web development team for creating this website and making this guide possible:

- Jeremy Stefek, Frank Oteri, and Mary Hallisey (NREL)

- Maggie Yancey, Liz Hartman, Coryne Tasca, Patrick Gilman, and Jocelyn Brown-Saracino (DOE)

- Maria St. Louis-Sanchez and Lauren Spath Luhring (WINDExchange)

- Matthew Kotarbinski and Amy Sedlak (NREL Research Program Participants)

- Sheri Anstedt, Katie Wensuc, Kathleen Morton, Heather Queyrouze, and Joelynn Schroeder (NREL).

Wind Energy Basics

Land-Based Wind Energy Development Overview

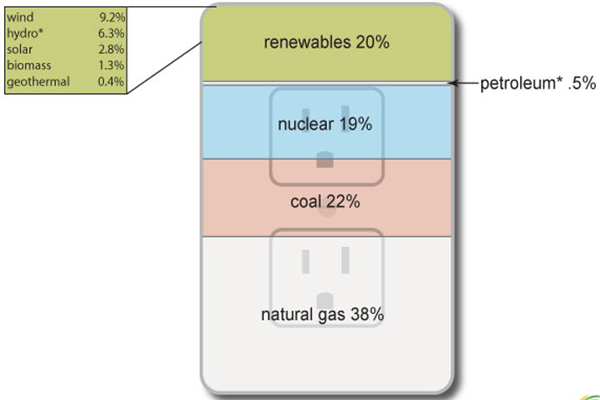

According to the Energy Information Administration (EIA), wind energy is the number one renewable energy generation source in the United States.

Sources of U.S. Electricity Generation, 2021

Total = 4.12 trillion kilowatthours

U.S. electricity generation by type and percentage for 2021. Source: EIA (2021)

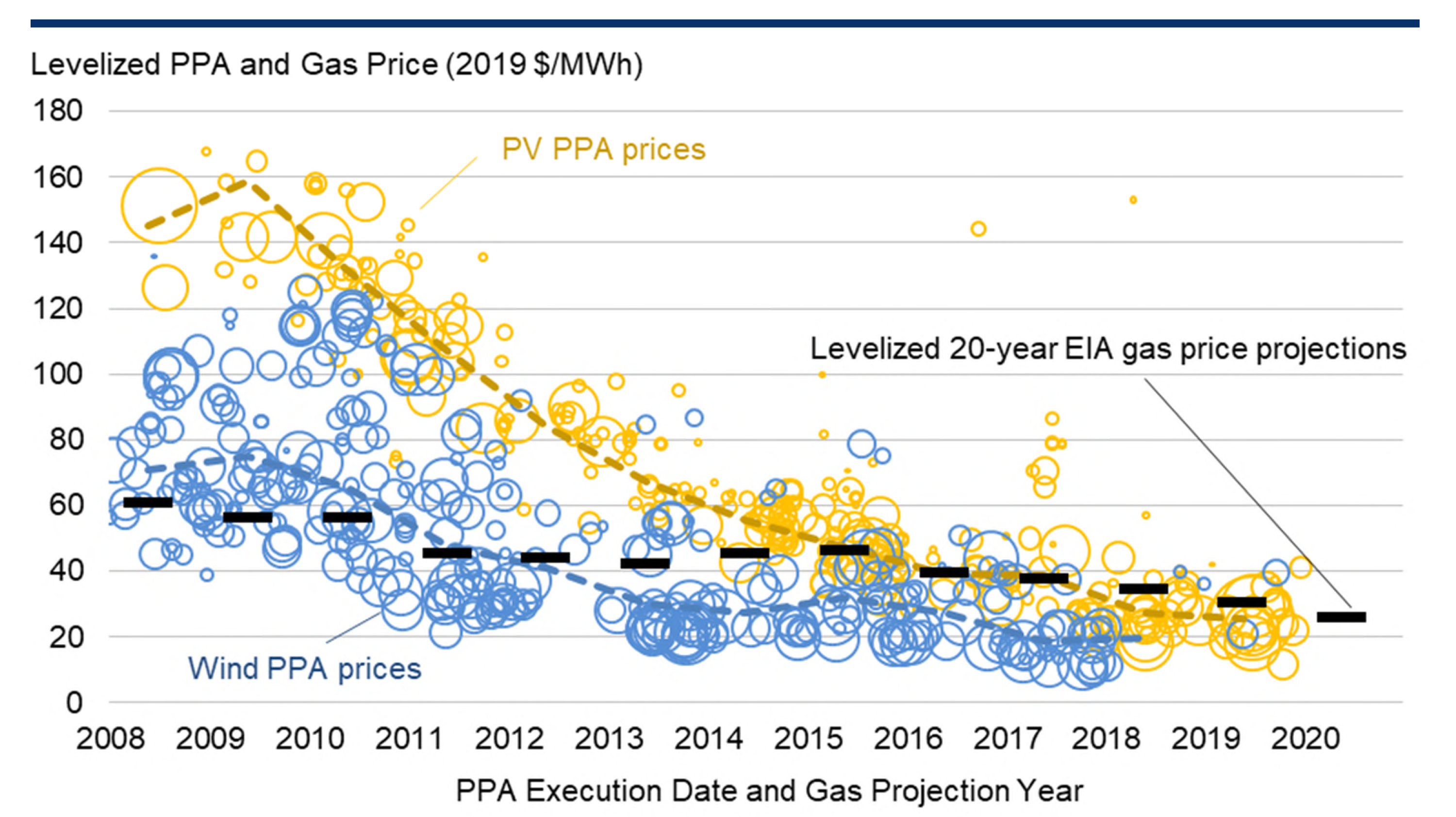

Since 2010, technological advancements and continued deployment of land-based, utility-scale wind energy have supported a decrease in project costs that has made wind one of the most cost-effective forms of energy in many parts of the country.

Although land-based wind energy has been used for many years in the United States, large utility-scale wind turbines were not common until 2000. At that time, the country's cumulative installed wind energy capacity was less than 1,000 megawatts (MW).

Land-based, utility-scale wind turbines are defined as turbines that exceed 1 MW in size. Other definitions for utility-scale wind include turbines with a 100-kilowatt capacity or more, but this is commonly used to describe the statutory cap for tax implications related to distributed wind. A wind farm (also referred to as a wind power plant, wind energy project, wind energy development, wind development, wind energy conversion system, or wind facility) is a group of turbines (from a few to hundreds) operated collectively as a single facility. Land-based, utility-scale wind farms are typically connected to the power grid, and the electricity produced by these developments can power homes or businesses nearby or far away―depending on power availability and demand.

Levelized Wind and Solar PPA Prices and Levelized Gas Prices

Overlay of wind and solar power purchase agreement (PPA) prices with the levelized price of natural gas to showcase the cost competitiveness of the two renewable energy resources. Source: Lawrence Berkeley National Laboratory (2020)

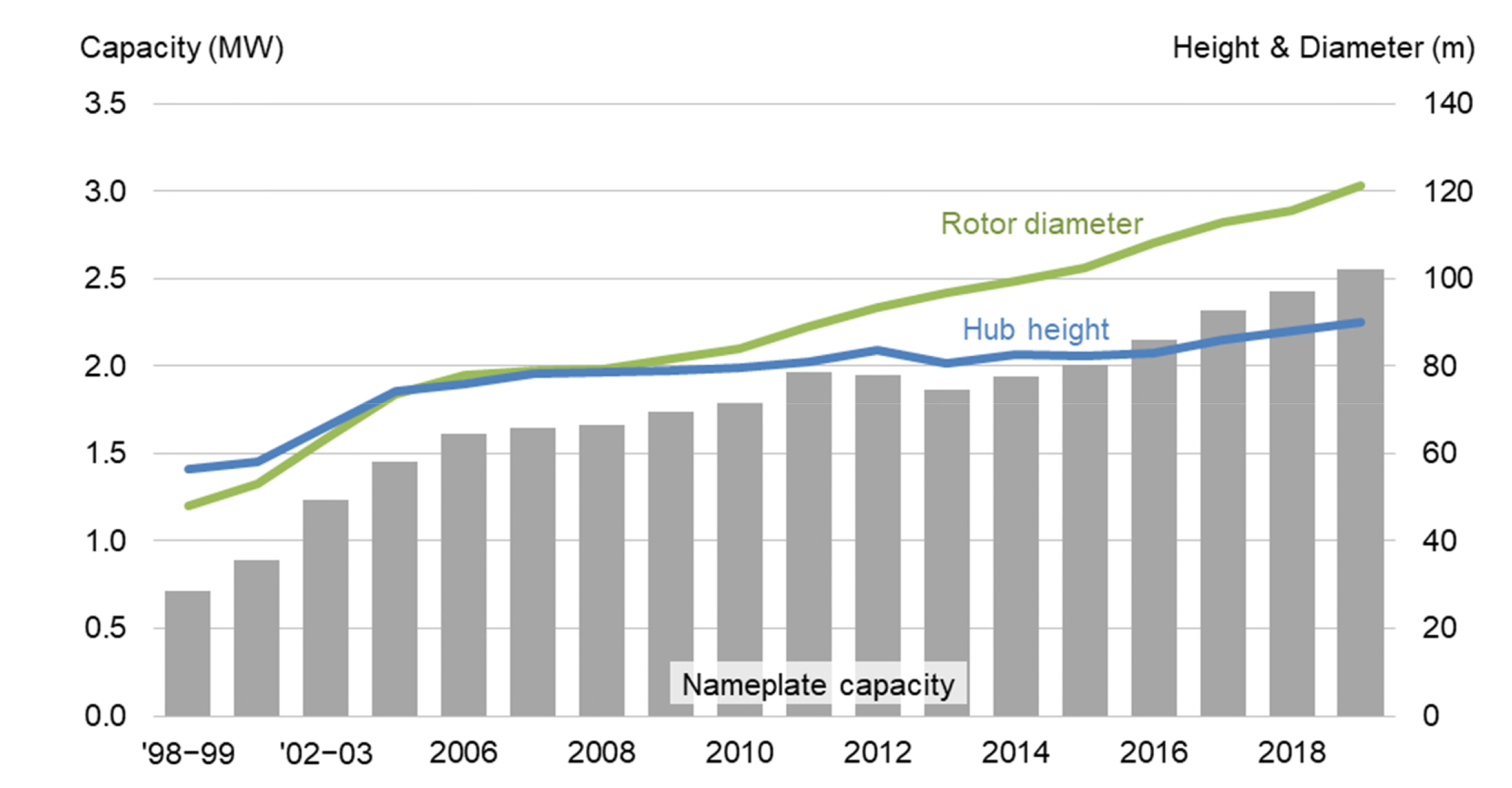

According to information in the U.S. Wind Turbine Database (USWTDB), the average size of a wind turbine installed in the United States through 2019 was 1.8 MW. According to EIA, 2019 electricity consumption for an average U.S. home was about 877 kilowatt-hours (kWh) per month. According to Lawrence Berkeley National Laboratory (Berkeley Lab), the average capacity factor for a single wind turbine installed in the United States is 35%. Given these assumptions, a single wind turbine would generate more than 462,180 kWh of energy per month—enough to power more than 527 average U.S. homes. That means that a single wind turbine would generate enough energy in 83 minutes to power an average home for 1 month. This calculation is based on the average wind turbine capacity and capacity factor of the entire U.S. wind fleet and the average household energy use in the United States for 2019.

To produce this much power, utility-scale wind turbines need to be tall enough to reach a strong wind resource. Depending on the local landscape and other development characteristics of a community, wind turbines might be the tallest object in a rural skyline. In 2019, the average installed turbine had a total height (base to tip) of approximately 494 feet (ft), with a hub height of approximately 295 ft and a rotor diameter of approximately 397 ft (Berkeley Lab 2020). The total height of new turbines built in 2019 ranged from approximately 404 ft to approximately 654 ft.

At the end of 2019, nearly 60,000 wind turbines with a total installed capacity of more than 105,000 MW were located in 41 states, with Texas leading the country in overall installed capacity (28,871 MW) and Iowa having the highest wind energy production as a share of total electricity generation (41.9%). In addition to the benefits created during the construction of these projects, the American Clean Power Association reports that wind energy supported U.S. communities by paying more than $1.6 billion to state and local governments and private landowners every year.

Average Turbine Nameplate Capacity, Hub Height, and Rotor Diameter for Land-Based Wind Over Time

Average nameplate capacity, hub height, and rotor diameter for land-based wind from 1998 to 2019. Source: Berkeley Lab (2020)

Find more information on the basics of wind energy via:

- DOE's How Do Wind Turbines Work?

- DOE's History of U.S. Wind Energy

- EIA's Wind Explained

- EIA's Electricity Generation, Capacity, and Sales in the United States

- DOE's What Is Generation Capacity?

Each state has wind energy characteristics specific to their state energy profile that shift as new projects are installed and new opportunities, organizations, and research become available. To better understand state wind energy profiles and see specific data, visit the WINDExchange Wind Energy State Information pages, which include:

- Capacity and generation—how much wind energy is produced

- Maps and data—assessing the resource potential of specific areas

- News and events—any specific local and relevant news or events

- Policies and incentives—WINDExchange has an ordinance database that can be searched by state

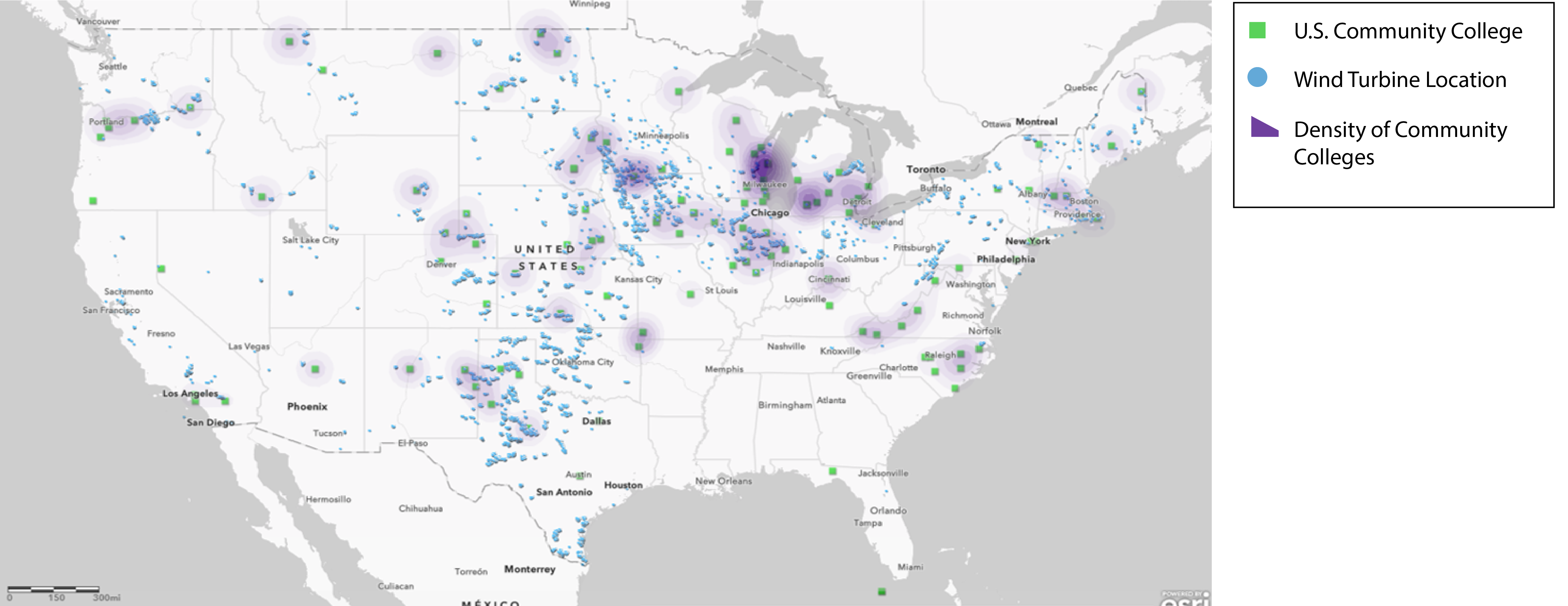

- Wind education and training—locations of universities and vocational institutions for training opportunities.

The ability to assess and characterize a location’s available wind resources is critical to the development, siting, and operation of a wind energy project. WINDExchange’s collection of wind resource maps illustrates estimates of the wind energy resource across the United States and provides key considerations that must be understood when weighing wind power options. Although these maps can provide a general, high-level indication of wind resources, developers use higher-quality resolutions and more site-specific data that incorporate local features, such as terrain complexities and ground cover. When developers design wind facilities, they supplement this high-level information with measured wind data from the site itself. Still, communities can use high-level wind resource maps to gain a general understanding of the potential for a wind energy project.

A key element of wind energy technology is the turbine height. When using wind resource maps, it is important to consider that the resource potential for an area might change when viewing 80-meter (m) (~262 ft) versus 100-m (~328 ft) maps. In 2019, the average wind turbine had a hub height of 90 m (~295 ft), but there has been a steady increase in the industry toward projects with tower heights of 100 m (~328 ft) or higher. This trend has resulted in more than 2,831 wind turbines proposed by the end of 2019, with maximum heights of more than 198 m (650 ft).

The USWTDB is an interactive map that provides the locations and details (e.g., name, year online, rated capacity, hub height, rotor diameter, total height, turbine manufacturer, and model) of land-based wind turbines in the United States. By zooming into a location, community members or decision makers can identify nearby communities that have wind development experience. As a best practice, learning from multiple expert perspectives and experiences will provide a richer understanding of some of the challenges and opportunities associated with the development process of any industry. Communities can also conduct additional research using the identified name of a wind energy project to identify the specific companies that are developing wind energy projects near their community. As with all online research, it is important to be diligent about checking sources and seeking out information from trusted, reputable entities.

Communities and localities across the country are defined by their unique values, physical characteristics, and demographic composition, which influences their vision for land-use planning practices and—therefore—important decisions about renewable energy development projects. Many communities respond in real time to proposals to develop a project in their area. Alternately, communities can be proactive by ensuring their values are reflected in the planning process. Either way, when communities define or redefine their priorities and needs, they should consider the role wind energy may have in achieving their overall goals. Many communities are required to establish comprehensive plans, land-use plans, and/or resource management plans that have sections addressing natural resources, land use, and energy. Including wind energy development in such planning documents can provide rationale for local energy-related decisions and help communities as they work toward defining their energy futures.

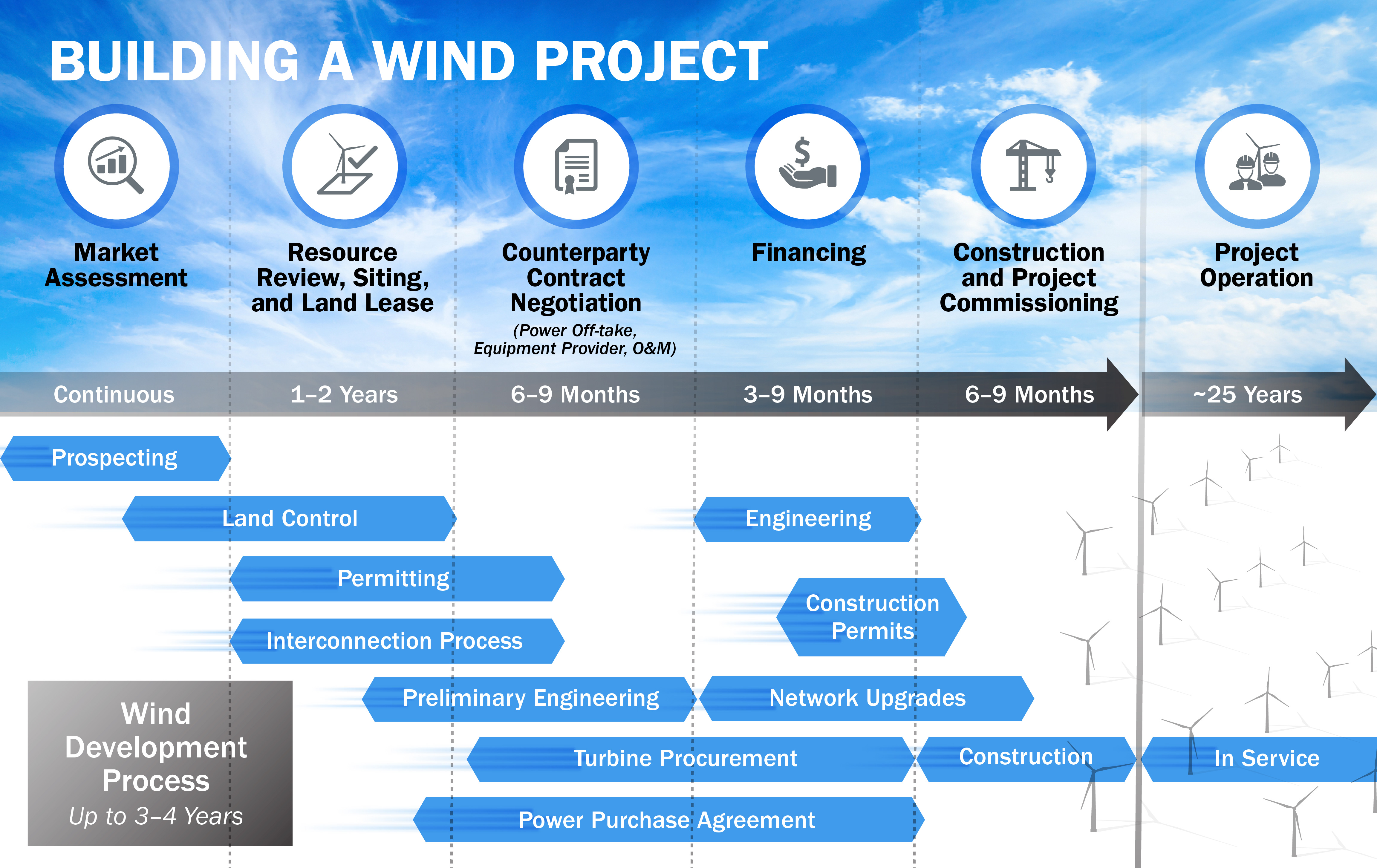

From prospecting through decommissioning, wind energy project development and operations are multistep processes that can span decades. Project development typically begins with identifying potential locations that have:

- A strong wind energy resource

- Access to electrical markets

- Available and suitable land

- Access to transmission

- Sufficient landowner interest.

Building a Wind Project

Illustration of the multistep, years-long wind energy project development process. Note: O&M: operation and maintenance; PPA: power purchase agreement. Image from American Wind Energy Association (2020).

Once locations have been preliminarily vetted, developers work with landowners to secure land rights by negotiating lease agreements and conducting thorough wind resource analyses. Other project development activities include studies and processes related to technical, biological, and cultural site assessments; the permit application; grid connection; offtake agreements; and acquiring financial resources. In the context of this guide, an offtake agreement is an arrangement between the developer/owner of a wind energy project and the party buying the energy that the project will produce and deliver over time.

Once project development has advanced sufficiently, engineering, procurement, and construction activities can begin. These activities include detailed engineering and design, procurement of wind turbines and other project-related equipment and materials, and construction and commissioning of generation facilities and related infrastructure. Once the operational lifetime of a project is complete (25‒40 years), the project is either decommissioned or repowered, though repowering can occur earlier if the project owners want to take advantage of new technology and/or available incentives.

Wind energy projects contain various elements regulated under local, state, or federal hierarchies. Some states require state-level permit approvals, whereas others leave this authority to local governments. Federal regulations apply to all developments in the United States. Federal agency approval is needed for factors such as airspace obstruction, radar and military compatibility, grid interconnection, and impacts to endangered species. Some federal agencies involved include the Federal Energy Regulatory Commission, U.S. Department of Defense, Federal Aviation Administration, and the U.S. Department of the Interior, which includes agencies such as the U.S. Fish and Wildlife Service.

Siting authority for a project can rest at either the local or state level or both and it is important for communities to know their state's regulatory jurisdiction. In most areas, the primary siting authority is the local government or a combination of the local government and state regulators (such as a public utilities commission); only four states grant siting authority exclusively to the state (West Virginia, Maryland, North Carolina, and Connecticut). In states with local siting authority, all aspects of siting and permitting a wind project are handled by local government officials, such as township trustees or county commissioners. These communities might still need to be aware of additional state approvals that can apply to wind energy projects. States with a hybrid local and state siting authority vary in how their regulations are structured. For example, authority might fall to local governments unless the project reaches a certain size (e.g., 25 MW); therefore, siting approval might need to be granted to developers by both local governments and state regulators, or state legislation might regulate certain aspects of wind energy projects, such as decommissioning or setbacks.

At the local level, wind energy ordinances are the primary regulatory mechanism, along with appropriate zoning. Ordinances are usually approved by commissioners at the county level, trustees at the township level, or the city council at the municipal level. Wind energy ordinances document local needs, preferences, and safeguards within county or city limits, or, in some locations, immediately outside of those jurisdictions. Although many communities might already have a wind energy ordinance, some of these laws may be outdated because of rapidly evolving turbine technologies that have been developed during the last decade. Older ordinances might need to be updated for current technologies with new siting approaches in mind, or they risk being overly restrictive or not restrictive enough.

Zoning is "the division of a city or county by legislative regulations into areas, or zones, that specify allowable uses for real property and size restrictions for buildings within these areas; a program that implements policies of the general plan. Zoning controls actions in certain land-use areas, including whether an individual can install a wind turbine in a particular location after obtaining the proper permits required by state and/or local authorities. Some jurisdictions have defined specific zones (e.g., wind energy overlay districts, renewable energy zones) that limit wind energy development to certain parts of the town/county where the overall impact will be minimal or, in some cases, where the wind resource is best. Others set uniform rules across the jurisdiction (e.g., for all properties zoned as agricultural).

The "Land-Based Wind Energy Siting Guide" provides community members with consolidated and accessible basic information related to community siting, including setbacks, light/flicker, sound, land use, military interactions, wind-wildlife interactions, and decommissioning.

The U.S. bulk power system—comprising a meshed network of electricity generators, electricity demand, and the transmission infrastructure to deliver the power—is a complex, interconnected machine that is transforming rapidly. Because the grid was originally designed to function with synchronous generators, such as hydropower, fossil fuel, and nuclear, there have been concerns about how incorporating variable energy generators, such as wind and solar, affects grid reliability. Studies have shown that increasing amounts of wind energy can be integrated into the grid without impacting overall power system reliability and that integrating significant levels of wind energy generation (up to 30%) is both technically possible and economically feasible. Grid operators across the United States now have measurable experience in integrating large quantities of renewables into their systems, and wind generation has met electricity demand over time at levels as high as 68.78% in the Southwest Power Pool in 2019. Detailed planning and operation studies of the power system by grid operators and power system stakeholders analyze what upgrades or changes in operation, if any, are necessary to interconnect wind to the power system. Additionally, wind energy project developers are required to conduct an interconnection study and evaluate any impacts to the existing power system to ensure there are no detrimental effects on grid reliability. Developers analyze the costs of any interconnection upgrades as part of their effort to determine overall project viability (Porter et al. 2009).

Transmission is often necessary to connect wind energy generation to load centers. The lead time to build new transmission is longer than the timeline for wind energy project development, making it important to address transmission needs in a timely and coordinated manner at both the regional and national levels. New transmission projects can take 5–10 years to plan and build, whereas new wind energy projects can take up to 3 years to build.

A common offtake arrangement for electricity produced by a wind energy project is a long-term contracted sale, most often in the form of a power purchase agreement (PPA). PPAs are contracts between energy producers (such as wind energy project owners) and buyers (utilities, corporations, or other large consumers) that specify transaction details, including the price that will be paid for the energy produced. In some cases, the buyer might be located in a state or region that is far from where the energy is produced. The term for these agreements is usually from 10–25 years. Other offtake arrangements include development-transfer or build-transfer agreements with local utilities, merchant offtake arrangements, virtual PPAs (selling power into the grid at wholesale rates with no guaranteed pricing), and financial swaps.

Depending on the amount of wind power produced and the local load and generation, wind energy might be consumed primarily at the local level or within a larger balancing area, or exported to a location where there is demand and need to balance the load. Because of the physical properties of electricity and the transmission grid itself, electricity flows where it is needed on the interconnected grid.

As with any infrastructure development, wind energy projects can impact the local ecological environment in a variety of ways. Development can result in direct impacts, such as bat collisions with wind turbine blades, or indirect impacts, including habitat disturbance. Because of the unique nature of each site, potential impacts should be assessed on a case-by-case basis, depending on the environmental resources and attributes of the local landscape. Many communities have questions about how birds, bats, and wildlife are affected by wind energy. Learn more about the wildlife impacts of wind energy on the WINDExchange website, which includes tools, webinars, and recent publications.

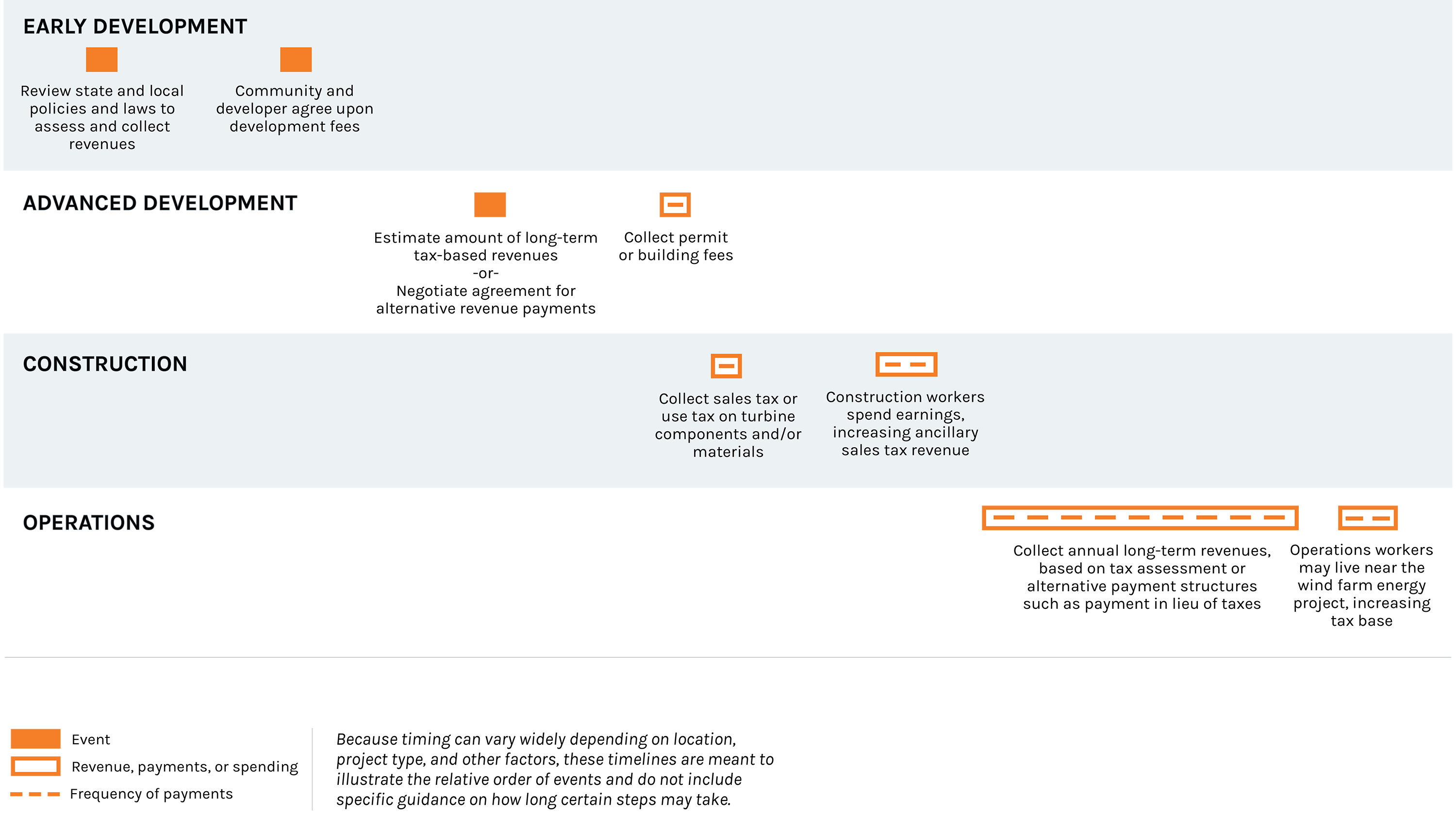

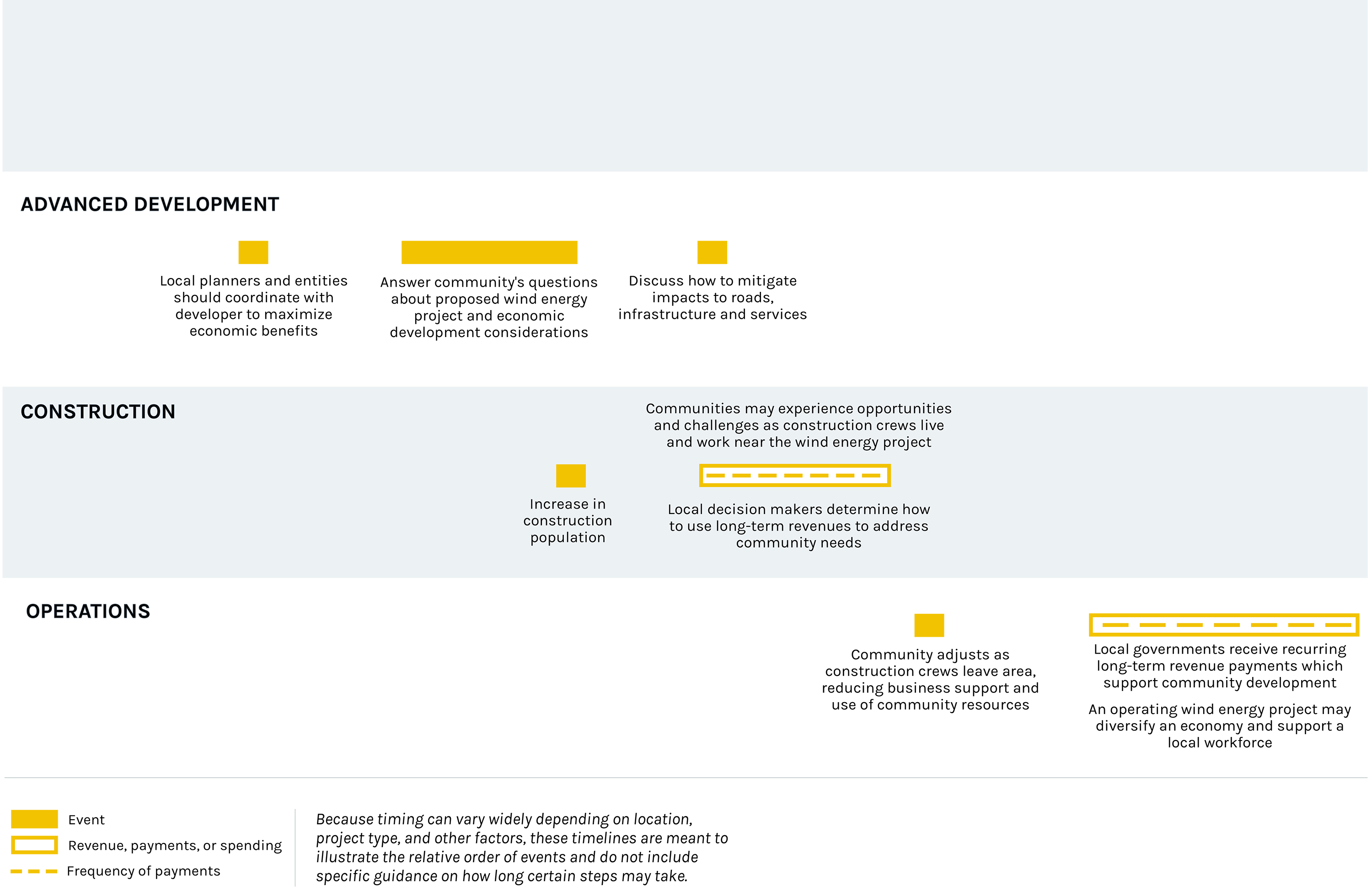

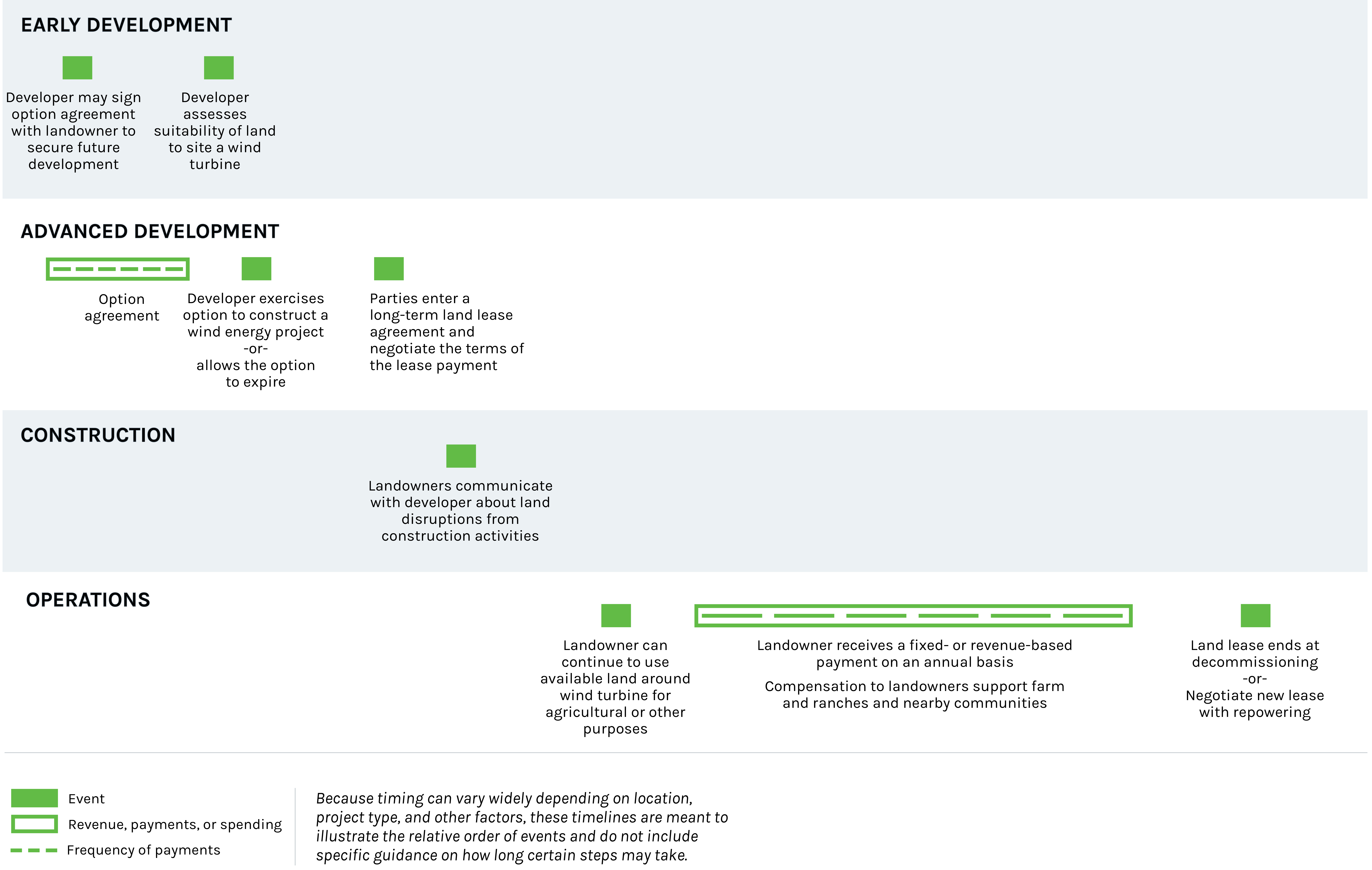

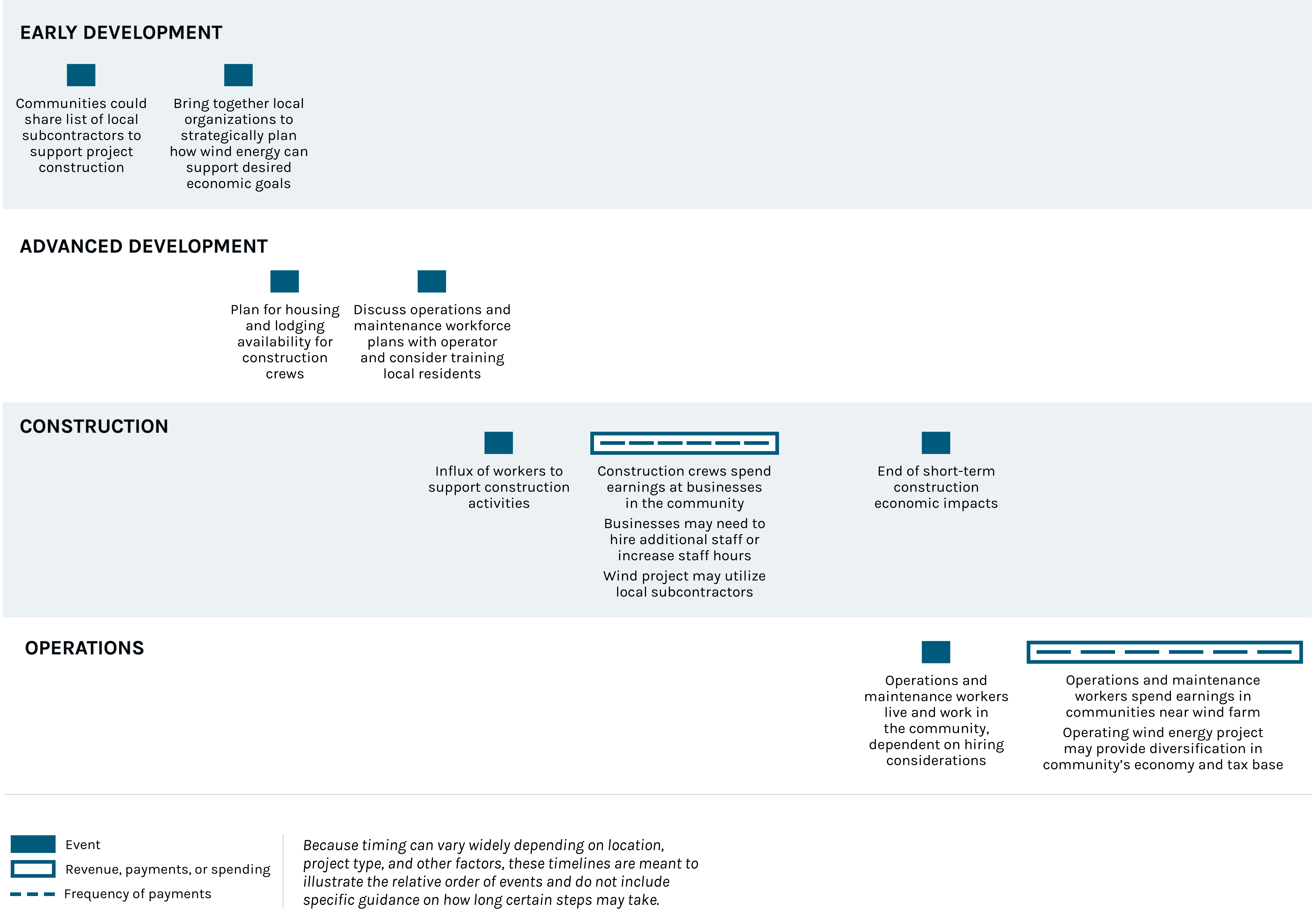

Economic Development Timeline

These four process timelines illustrate how local governments, communities, landowners, businesses, and local workforces are impacted by the various stages of wind energy development. Because timing can vary widely depending on location, project type, and other factors, these timelines are meant to illustrate the relative order of events and do not include specific guidance on how long certain steps may take.

Additional Resources

- A collection of informational slideshows covering topics related to wind energy, such as benefits, impacts, integration, and effects on avian species.

- The "History of U.S. Wind Energy"; highlights many advances that wind power has made over time.

- The "What is U.S. electricity generation by energy source?"; web page provides utility-scale wind energy generation in 2019.

- The "Wind Energy Technology Data Update: 2020 Edition"; summarizes key installation, industry, technology, performance, and cost trends in the U.S. wind power market.

- The "2020 U.S. Energy and Employment Report"; gives a breakdown of energy employment by industry.

- The National Renewable Energy Laboratory Wind Prospector provides data from the Wind Integration National Dataset (WIND) Toolkit—including wind profiles, power data sets, and forecasts—for a more detailed look at wind resources across the United States.

- A fact sheet on wind energy from the Center for Sustainable Systems at the University of Michigan.

Local Government Revenues

Overview

Counties and other government entities that allow wind energy development in their communities can receive revenue from such developments through taxation, payments, fees, and other compensation. This overview section defines the various local wind-related revenue structures and provides examples highlighting how local decision makers could use this revenue in their communities.

This guide does not provide recommendations on which wind-related revenue structures are most appropriate for a community. Instead, it collects, categorizes, and characterizes potential economic revenue mechanisms that communities and community members might realize if they allow wind energy developments in their area.

By expanding the overall understanding of local wind-related revenue structures that other communities have received during the planning, construction, and operation of a wind energy project, communities new to this type of development can be better prepared to maximize the local revenue related to wind energy. This section focuses on four revenue-related topics:

- Community considerations. Because of different tax assessment procedures and authorities, each community will likely have a unique experience during the approval, assessment, and collection of revenue from wind energy.

- Development fees. Typically comprising a one-time payment, development fees are usually expected prior to or during wind energy project construction. These fees include application or building permit fees and sales or use taxes. Sales or use taxes are collected during the development phase and are related to large construction purchases, such as wind turbine components or construction materials.

- Recurring long-term revenue. Recurring long-term revenue is an ongoing source of revenue for the local county or municipality, providing community benefits during the lifetime of the wind energy project. This recurring revenue is often associated with payments from property taxes or community-negotiated agreements on an annual basis.

- Ancillary revenue. Communities realize indirect revenue supported by a wind energy project, often sales tax revenue, which is collected from products, goods, materials, and services purchased during project construction and operation and maintenance. Local businesses—such as grocery stores, restaurants, and hotels—will likely see an increase in business during the construction phase. In addition to providing direct sales revenue to those businesses, increased sales also provide significant ancillary revenue through sales taxes paid by construction and operation workers who spend earnings in the community, increasing the local tax base.

The Additional Resources page provides resources for state-specific revenue information.

Timeline

This process timeline illustrates how local governments are impacted by the various stages of wind energy development. Because timing can vary widely depending on location, project type, and other factors, the timeline is meant to illustrate the relative order of events and does not include specific guidance on how long certain steps may take.

Local Government Revenue Sources

Community Considerations

State and local policies and laws can dictate how community decision makers assess and collect revenue from wind energy projects. Communities considering wind-related revenue should note:

- Approaches vary by state, county, and locality, with some states allowing multiple approaches or allowing local governments to negotiate various structures.

- The authority to select different revenue structures does not guarantee more or less revenue for a community. Some communities have more authority to negotiate agreements with wind energy developers, whereas other communities must adhere to taxation, abatements, or exemption structures allowed under state laws.

- Revenue can be assessed by the state or county, or it can be agreed upon between the developer and community, depending on existing guidelines.

- Developers and communities play an important role in ensuring the economic viability of a wind energy project. This can be observed especially in the taxation of these developments. For owners/developers, tax considerations play a role in selecting a location for the wind energy project. For communities, the additional revenue provided through the taxation of wind energy projects can support economic development as part of a larger economic strategy.

- Some revenue structures are designed to reduce deployment barriers for developers while supporting economic development in local communities, such as payment in lieu of taxes (PILOT) and good neighbor payments.

Development Fees

Development fees can be assessed or agreed upon by the community and developer prior to wind energy project construction; however, the developer might pay these fees prior to the start of construction (e.g., building permit fees) or during construction activities (e.g., sales tax on equipment purchases). The three most common types of development fee revenue streams are:

1. Sales tax. A transaction-based, consumption tax at the state, county, and/or city level that is charged on an item at the time of purchase. Local material and equipment purchased during project construction can generate additional tax revenue for communities and states that have instituted this tax mechanism.

McLean County, Illinois uses a multi-faceted approach to promote wind energy development while supporting the county tax base. The county provides a tax exemption for major wind turbine components, such as blades, towers, and nacelles; however, the county charges sales tax on ancillary components, including electrical equipment, turbine foundation materials, and turbine replacement parts. Additionally, the county collects application fees during the wind energy project permitting process that support the construction permit review.

Information compiled based on an interview with Philip Dick, planning director of McLean County, conducted by National Renewable Energy Laboratory (NREL) staff Matthew Kotarbinski and Amy Sedlak, August 20, 2019.

2. Use tax. Applied to goods and materials purchased outside the community but consumed in the community where the wind energy project is located, such as when a developer brings wind turbine components or construction materials into a community. Counties could decide to impose or exempt a developer from a use tax.

Lincoln County, Colorado, collects a 2% use tax on materials imported into the county for wind energy development. A use tax generates tax revenue for purchases made outside of the local tax authority's jurisdiction. This use tax was approved by the county and is levied on the wind energy project developer. Lincoln County collected $2.65 million from the developer of the 600-megawatt (MW) Rush Creek Wind Farm during its construction in 2018.

3. Permit or building fees. A one-time fee typically collected during the application phase of the permitting process that can be used to compensate counties for the cost of reviewing and processing applications for the proposed wind energy project to ensure the overall design adheres to characteristics of the area and local standards for land use, zoning, and construction. Project size and location usually dictate whether a state, county, or municipal government is authorized to oversee the permitting of a proposed wind energy project and the collection of associated fees. Permits of this type are related to building, road use, and zoning considerations. The fee assessment is typically outlined as part of a permit or ordinance, as shown in an example from Cheyenne County, Colorado.

The agency with the authority to review and assess development fees is an important consideration for counties. In Oregon, if a proposed wind energy project exceeds 105-MW capacity, the state has jurisdiction over the permitting; if the project capacity is less than 105 MW, the county-level government has siting authority. From a revenue standpoint, this is an important differentiation because the authority that reviews the application or permit might assess a fee to cover the technical review costs incurred by the government. If a county has the expertise to review the applications, the fees might be more impactful at the local level, adding a revenue stream to county budgets to sustain staff and services.

Morrow County, Oregon, charges a fee to review permit applications for wind energy project developments less than 105 MW. In Oregon, fees at the county level are generally much less than state permitting fees to encourage the development of wind energy projects that keep the permitting authority local. It is important, however, that communities charge enough to be able to conduct due diligence regarding the wind energy project during the permitting approval process. In Morrow County, officials had to revisit permitting fees after realizing additional funds were needed to cover personnel review time, so the county added $750 per megawatt to the existing permitting fee.

Information compiled based on an interview with Carla McLane, planning director of Morrow County, conducted by NREL staff Matthew Kotarbinski and Amy Sedlak, July 18, 2019.

Chaves County, New Mexico, is one of three counties that are home to the Oso Grande Wind Project. Chaves County is unique because it is the only county in the region with a building inspector. Because it has a building inspector, the county does not need to rely on the state for building permit approval; therefore, any fees generated from the permitting and application process remain in Chaves County. These fees are paid by the developer to the county and can support county staff to review the permit or other services. In the surrounding counties, the state approves the project and any fees generated from the permit application are allocated to the state.

Information compiled based on an interview with Luis Jaramillo, planning director of Chaves County, conducted by NREL staff Matthew Kotarbinski and Amy Sedlak, June 12, 2019.

The use of these revenue streams is at the discretion of local decision makers. Prior to construction, these payments could fund the county's review of permit applications, prepare the community for an influx of construction workers, or support county services such as emergency medical services. After construction, these payments could support community revitalization projects, a savings fund, or infrastructure improvements such as roads.

Recurring Long-Term Revenue

The recurring long-term payments counties and local governments receive from wind energy projects are the most consistent and major economic benefit associated with this renewable energy resource. Typically, this revenue is earned on an annual basis.

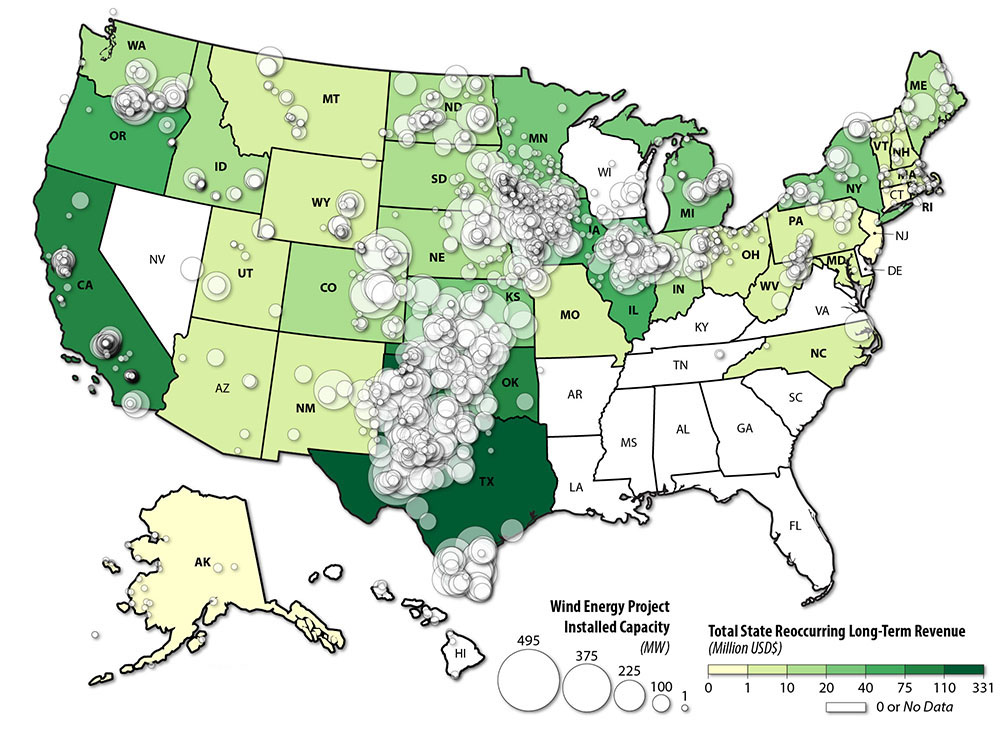

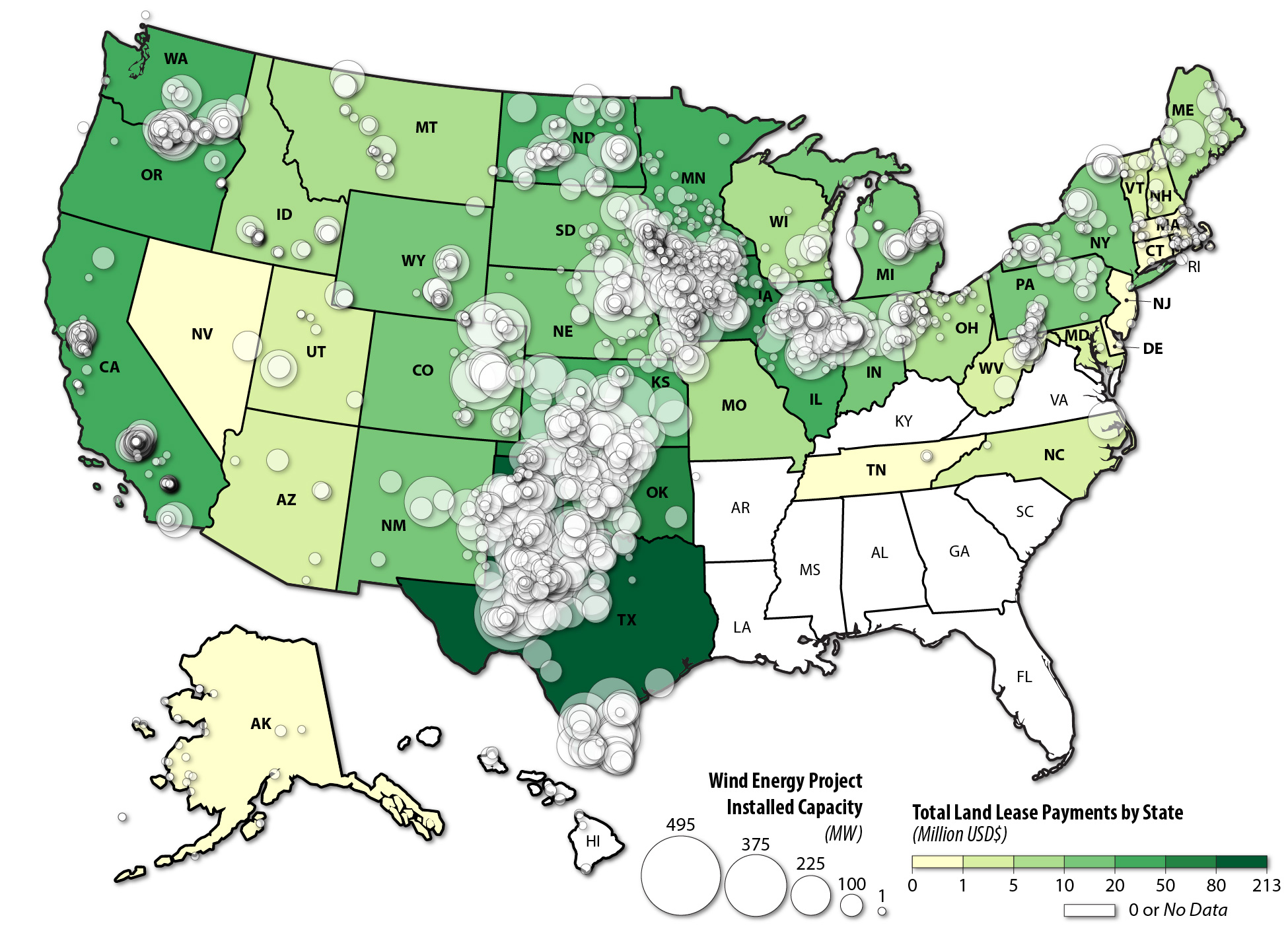

The American Wind Energy Association, now called American Clean Power, estimates that the U.S. wind industry paid $912 million in state and local tax payments in 2019. The following map shows the locations of wind energy projects across the United States and the average reoccurring (annual) tax-based or alternative revenue for each state. A comparison of the different revenue dollar amounts between projects or states is difficult because of many factors, including differing property values across the United States, the technical characteristics of the wind energy projects, and varying agreements between landowners and developers.

The total reoccurring revenue in this map represents tax-based and alternative revenue payments. Revenue from a wind energy project is typically collected annually during its lifetime.

State and local tax revenue are generated in communities located near respective wind energy projects. Source: U.S. Wind Turbine Database, American Clean Power 2019.

Under both tax-based and alternative revenue structures, the revenue from wind energy projects flows back into counties and communities. For tax-based revenues, state and local governments can use different methods to calculate the tax revenue from a wind energy project. Depending on tax laws, taxes can be assessed at either the state or county level. Many communities can also approve abatements or exemptions to reduce tax burdens and encourage development. Whereas alternative revenue agreements can be negotiated between developers and communities often in place of a tax-based structure. These revenue payments are usually a consistent amount paid annually to a local government entity.

To understand the options for long-term revenue structures, communities might work with peer counties that have wind energy development experience, the state authority, and the developer. Local decision makers can decide how to best use this revenue to support a wide variety of community economic development projects, as detailed in the Community Development Information section.

Tax-Based Revenue

State, county, or local governments annually conduct a valuation and collect taxes from a wind energy project owner/operator. The tax valuation depends on specific tax assessment laws and policies. Revenue is collected from the wind energy projects owner/operator during the lifetime of the project, typically 25–40 years.

This type of taxation is an ad valorem (property) tax assessment at full and true value on the land, wind turbine components, or ancillary components, or a combination of multiple approaches. Land, building structures, and other property (e.g., vehicles) associated with the wind energy project might be considered real property, whereas wind turbine components might be considered personal property. Tax or mill rates can vary based on the wind energy project's location, and the assessment can include depreciation. This structure is typically used in areas with lower property tax rates or where wind development is uncommon.

Community Examples: Standard Taxation in California

The California State Board of Equalization provides guidelines to assess the value of wind energy projects using existing state property tax rules. Wind energy projects in California are assessed at the county level, and a valuation is based on sales, cost, or income approaches outlined in standardized tax rules. Kern County, California, has hosted wind energy since 2005, with a current installed capacity of 4.2 gigawatts from approximately 2,000 wind turbines. The Rising Tree Wind Farm reported $17.5 million cumulative payments to local government between 2010 and 2019. The California State Board of Equalization offers guidelines for assessing wind energy project properties.

This tax is related to the size of a wind energy project or how much energy it produces. To determine tax liability, the valuation might use one method or a combination of nameplate capacity, production tax, or income generation. State or local authorities usually decide which valuation method to use. A tax based on nameplate capacity, production, or income generation often takes the place of property or other tax-based revenues collected from wind energy projects.

- Nameplate capacity. A tax rate multiplied per maximum wind turbine output for each turbine. Typically an annual tax expressed in a dollars per megawatt.

- Production. A tax rate multiplied by the amount of electricity generated by a wind energy project. Typically an annual tax expressed in dollars per megawatt-hour.

- Income generation. Assessing the income generated by the wind energy project can provide a way to value a tax payment. This could include a tax on a percentage of gross energy earnings from a commercial wind energy project.

Community Examples: Distribution Models for Tax Based on Nameplate Capacity, Production, or Income Generation

State tax policies can specify how revenues are assessed and distributed back to states, counties, or municipalities. The Nebraska Department of Revenue assesses taxes on wind energy project owner/operators based on nameplate capacity. The state collects tax-based revenue on an annual basis and redirects the revenue to a county treasurer where wind energy projects are located with no specific restrictions or requirements for distribution of funds. In South Dakota, the South Dakota Department of Revenue collects a nameplate capacity and production tax from wind energy projects on an annual basis. The department deposits this revenue into a renewable facility tax fund, and then distributes a set percentage to the counties where projects are located, while the remaining funds go to the state general fund.

Tax revenue from the wind energy project is based on a calculation that could include an assessment ratio or a multiplier, a depreciation, millage tax rate, an assessment of the land beneath the wind turbine or easement, an evaluation of the wind energy asset, or a combination of these approaches. These tax calculations could also include a tax abatement or an exemption, usually during a period with a percentage decrease in tax burden.

An abatement is a specified reduction in the assessed value or tax rate applied to a wind energy project. This full or partial decrease in tax burden is typically agreed to at the state or local level. Abatements or exemptions are incentives that encourage wind energy project development by reducing a developer's tax burden. When a county extends a tax abatement or an exemption offer to a wind energy project developer, the proposal will often require a payment in lieu of taxes (PILOT) or other compensation agreement from the company. For example, a project could receive a 10-year tax exemption for all property following the construction or installation of a wind energy project. As part of this agreement, the company could be required to provide the community with a donation; the terms of which are typically negotiated and agreed upon during the tax exemption process. Another example is when a community offers a 100% tax exemption for the land and the facilities in exchange for a PILOT equal to 1% of the gross income generated from electricity sales.

Alternative Revenue

Alternative revenue is defined as negotiated agreements for nontax-based or other revenue that typically occur at the county or municipal level. Not all counties or municipalities have the option to negotiate compensation with a developer because a wind energy project siting authority or a state policy might prescribe a certain valuation structure. Communities should also be cognizant of the experience needed to negotiate agreements with developers, especially the first time, and they might wish to consult peers for support. The Institute for Energy Economics and Financial Analysis released "Negotiating Responsible Tax Breaks on Renewable Energy Deals: A Guide To Community Due Diligence," which includes information on best community practices for negotiating renewable-energy agreements.

A payment in lieu of taxes is a payment structure used in place of a tax-based revenue structure, which is allowed in certain parts of the country. A PILOT agreement changes the tax burdens the wind energy developer would pay during the lifetime of the facility. PILOT agreements are often negotiated between the developer and decision makers in the local community. Payment in lieu of taxes are referred to as PILOT or PILT payments, with the terminology varying across states.

Community Examples: PILOT Considerations

PILOT structures deliver revenue to local governments while providing developers with property tax relief. Even though a PILOT agreement removes a conventional tax-based revenue structure, the local communities still receive consistent payments of an agreed-upon amount on an annual basis. By creating a lower levelized cost of payments spread throughout the lifetime of the project, PILOT structures ensure steady payment, regardless of how much the value of the land or the equipment fluctuates and independent of changing state and local tax policies. Additionally, PILOTs can be part of a larger economic negotiation that includes formalized agreements intended to increase local economic impacts, such as local labor requirements and/or the acquisition of community development funds.

An HCA is an alternative payment agreement that provides a long-term revenue stream and other benefits to a local government to mitigate wind energy project impacts. HCAs are also known as extended community impacts, developer community investments, and good neighbor agreements. These contracts are negotiated between the wind energy project developer and the local municipality and help the developer build project support in the local community. Communities can decide how to use payments to support economic development in their local community. In addition to a payment, these contracts can include agreements to cover potential negative community impacts during the construction or operation of the wind energy project, such as impacts to roads, setting up a complaint hotline, or decommissioning. HCAs are frequently used in New York.

Community Examples: Host Community Agreement and PILOT

In New York, communities can receive revenue from PILOT agreements and HCAs. New York is a home-rule state where local municipalities and county-level industrial development authorities can negotiate with wind developers. In Wyoming County, a PILOT agreement was negotiated between the industrial development authority and the wind energy project developer to provide a stable annual revenue payment to support the county.

In addition to the county receiving revenue from a PILOT, local towns closest to the wind energy project might negotiate a dollar-per-megawatt HCA fee to support economic development and address potential negative community impacts. Common methods to address potential negative community impacts that can be included in HCAs include one-time in-kind payments for community improvements, emergency services stipulations, a citizen complaint management program, and decommissioning agreements.

In New York, where property taxes are high, PILOT and HCA structures enable wind energy project development by creating alternative payments that compensate a community at a rate that reduces the overall tax burden for developers.

Information compiled based on an interview with William Daly, planning and development director of Wyoming County, conducted by NREL staff Matthew Kotarbinski and Amy Sedlak, July 15, 2019.

Commonly applied to wind energy projects in Oregon, this structure allows local governments to negotiate alternative revenue payments with large job creators, including wind energy projects. SIPs include a 15-year tax exemption with a monetary threshold that fluctuates depending on the local population of a specific project. They also include an annual service fee that acts as an alternative revenue payment. In general, SIPs offer an incentive for developing capital-intensive ventures, such as wind energy projects. Business Oregon provides an overview of SIPs in the state.

Community Examples: Strategic Investment Program

As part of its SIP, Sherman County, Oregon, negotiated an alternative revenue payment with a wind energy project developer to provide a low fixed-rate annual payment during the project's lifetime. Sherman County decided on how the revenue is allocated within the county. SIPs, which are unique to Oregon, provide counties more financial flexibility while allowing the developer to negotiate a fixed revenue payment instead of a standard tax assessment.

Information compiled based on an interview with Tom McCoy, commissioner of Sherman County, conducted by NREL staff Matthew Kotarbinski, Amy Sedlak, and Jeremy Stefek, July 10, 2019.

Commonly used in New Mexico, IRBs fund large industrial projects wherein the local government secures a bond for project's construction. In this structure, real or personal property that is part of the wind energy project is deeded to the county or municipality. The county or municipality then leases the project back to the developer. This allows the project to be tax exempt for as long as the bonds are outstanding. The developer is obligated to purchase the project when the bond matures. If an IRB is approved by the county, the county forgoes taxes, so a PILOT or other alternative revenue is often negotiated. The city of Albuquerque provides a summary of IRBs in New Mexico.

Ancillary Revenues

Employees at wind energy projects tend to spend their earnings in the communities where they live and work during the construction and operation of the project. This spending generates sales tax revenue for localities, which is ancillary revenue not directly related to development fees or recurring long-term revenues collected though wind-related specific tax policies or agreements.

During construction, communities will likely experience an increase in sales tax revenue from construction workers and wind energy project developers. Construction workers spend earnings at businesses such as restaurants, grocery stores, lodging, and retailers. Project developers might spend money in the local community, on worker lodging and construction material purchases at businesses such as gas stations and hardware stores. The amount of sales tax revenue will depend largely on the percentage and distribution of taxes based on local and state policies.

The direct sales tax revenue from purchases made in the community is difficult to quantify. The magnitude of this additional sales tax revenue depends on the size of the wind energy project and number of workers that support construction activities. A study near a wind energy project in Lincoln County, Colorado,surveyed businesses during the construction phase. Most businesses (67%) reported that overall revenue had increased because of wind energy project construction. The development of the wind energy project was noted as beneficial to businesses in the community (72%), and 61% of businesses expected to see an increase in business profitability, sales, or general growth alongside the following year's construction activities. An increase in business revenue should be correlated with an increase in sales tax revenue because construction workers support local businesses in counties near wind energy projects.

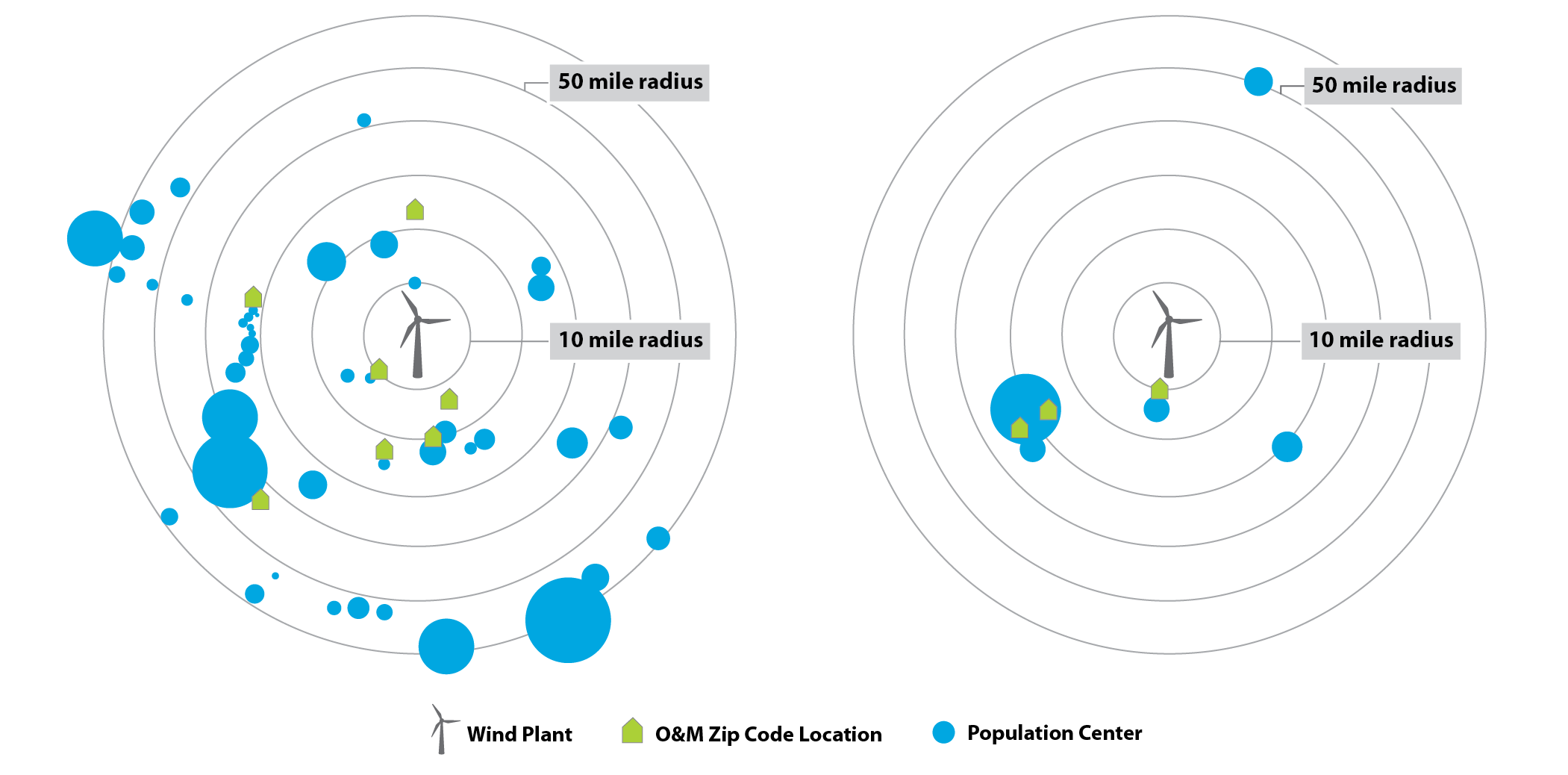

During wind energy project operations, operation and maintenance workers often live in nearby communities, contributing to an increase in the long-term local tax base. A December 2020 report indicated that 80% of workers "agree" that they spend money in the community they work in during or immediately after a workday. Wind energy project workers spending part of their earnings correlates with supporting local businesses and generating sales tax revenue for local governments. This report showed that economic impacts could be spread among communities, but communities can expect a wind energy project to support between 0.18 and 0.98 full-time equivalent jobs per megawatt at local businesses supported by wind workers and between $10,000 and $58,000 per megawatt in taxes to the local, state, and federal government.

Additional Resources

Each state has different policies regarding the collection of tax revenue from wind energy, especially for property taxes or payment in lieu of taxes (PILOT) or similar structures. State agencies can provide information on the assessment and collection of taxes from renewable energy projects. As tax policies may change, please check with a state or county assessor for the most current valuation methods. Click on a state to find more information about each state’s tax considerations.

Community Development Information

Community-Based Examples

The taxes, fees, and other revenue generated from the development of wind energy projects are used in a variety of ways, depending on the needs and priorities of the local community. Some communities have used wind energy revenue to increase funds allocated toward school budgets, reduce the tax burden of homeowners, address community needs through local infrastructure projects, improve essential local services, and support other local investments. This section of the "Land-Based Wind Energy Economic Development Guide" highlights some ways communities have invested their local wind energy revenue.

School districts are often the beneficiary of revenue payments received by communities from wind energy projects. Although schools in Oklahoma and Ohio are provided as examples, many school districts are impacted by revenue accessed from wind energy developments.

In their national analysis of school district finance and student outcomes data, researchers at Lawrence Berkeley National Laboratory, University of Connecticut, and Amherst College found a strong correlation between wind installation capacity and increased school revenue and expenditures. Their analysis of 638 districts across 35 states found that each megawatt (MW) of wind added in a school district increased school revenue and expenditures by roughly $3,800 per student annually. For an average wind energy project in an average school district (of 0.243 MW of wind per pupil), the school earns and spends an additional $920 per pupil per year. The study also found evidence of slightly smaller class sizes but no effect on student test scores.

Researchers from Oklahoma State University recently attempted to quantify the economic impact that wind energy projects had on school districts in the state. At the end of 2017, Oklahoma had 7,496.6 MW of wind energy capacity installed in 26 counties containing 62 school districts. The report determined that "Of the 62 school districts containing wind energy projects, 32 of those districts receive no state foundation aid. Additionally, 21 of those districts receive no state foundation aid nor do they receive any state salary incentive support." Further, the data revealed that, "Of the ad valorem revenue created by existing wind energy projects, $919 million are revenue paid to local school districts and Career Tech districts..."

Okarche Public Schools is one Oklahoma school district that has benefited from the tax revenue provided by the development of wind energy projects. In 2017, a midyear state budget cut affected many school systems in Oklahoma, but the tax revenue from wind minimized the impact these cuts had on the Okarche school district. Additionally, the funding allowed the school system to take full advantage of a voter-approved bond package to build a gymnasium, an elementary school, a fine arts center, and an agriculture and technology building. Further, one year later, wind energy revenue allowed the school to establish a music program for the first time in 40 years.

Though Okarche Public Schools has benefited from wind energy revenue, there have been challenges related to the revenue assessment and collection process. Specifically, one wind energy company in the area was not awarded an expected tax exemption, which led to the company filing a tax protest to determine an appropriate outcome. This delay temporarily left Okarche with a budget deficit of nearly $1.5 million, as they awaited the result of the tax protest. Decision makers should understand that reliance on singular forms of revenue to support community development can leave local jurisdictions vulnerable during any potential revenue-related conflicts that require outside resolution. Regarding wind energy, local decision makers and school systems should understand that there is the potential for disagreements in the valuation or collection of these payments that can impact spending or create temporary budget shortfalls.

Wind energy revenue has also impacted school systems in other states. For example, in Van Wert County, Ohio, the developer of the Blue Creek Wind Farm—Avangrid Renewables—is the largest single taxpayer. With 75% of the project located in Van Wert (the remaining is located in nearby Paulding), the county benefits from a majority of the $2.7 million in annual tax revenue paid to local tax bodies. As a result of the payment in lieu of taxes (PILOT) agreement between Avangrid Renewables and Van Wert, the Lincolnview Local Schools district is able to collect $400,000 per year for 20 years. The school district has been able to expand its education curricula and school resources. Specifically, the school system purchased Chromebooks for 915 K–12 students. Additionally, they were able to implement two new courses in pre-engineering and biomedical, and they hired multiple teachers as well as a special education director and a curriculum director.

Prior to project approval, governments and communities can negotiate specific terms and conditions with a developer that can provide a community with the means to improve local resources. Improvements can include infrastructure upgrades, such as road expansion, support for emergency services, and the development of new community centers and libraries. Funding mechanisms that have been used to support and improve community resources include host community agreements, strategic investment program (SIP) agreements, good neighbor payments, and sales-and-use taxes.

In Morrow County, Oregon, community improvements from wind energy projects have been funded as part of SIP agreements. SIP agreements allow projects to pay a portion of their income to local entities in lieu of property taxes, but only after paying taxes on the first $25 million in taxable income. In 2019, Morrow County entered into an SIP agreement with Orchard Windfarms. The SIP agreement included a community service fee that defined the local entities that would benefit under the SIP, including the Morrow County Health District, the Morrow County Unified Recreation District, the Port of Morrow, and the Umatilla Morrow Radio District.

Because of the county use tax, the Rush Creek Wind Farm has contributed approximately $2.65 million to Lincoln County, Colorado. The Lincoln County Economic Development Corporation has explored ways to use some of this revenue to upgrade local infrastructure to attract people to live and work in the county. The county has been considering using this money to build a new pool, upgrade the fairgrounds, and make other community improvements.

In general, wind energy project developers might need to improve local roads to accommodate component delivery or repair roads once construction is complete. In many agricultural areas, project access roads are built and can be used by farmers once a project is complete.

Revenue generated from wind developments has the potential to reduce the tax burden for residents in the state and local region where the wind development occurs.

As a result of a PILOT agreement in Wyoming County, New York, the town of Sheldon was able to eliminate local taxes for 8 consecutive years after the construction of the High Sheldon Wind Farm. Though local taxes were eventually levied in 2016, the following year the town received approximately 58% of its budgeted revenue from serving as a wind turbine host community. The Town of Eagle, New York, was also able to eliminate local taxes because of the development of wind energy projects in the area. Since the construction of the Bliss Wind Farm project in 2008, residents of Eagle have had their town taxes reduced to zero and other community improvements have also been completed without expense to the taxpayers. These improvements include road enhancements, new snowplow vehicles, and no-fee garbage collection.

In New Mexico, wind energy projects on state trust land partially contributed to each taxpayer in the state saving approximately $1,500 in 2019. Overseen by the New Mexico State Land Office, wind development on these lands is expected to generate revenue of more than $800,000 in 2020. The revenue from these projects is a percentage based on the sale of electricity generated and contributes to the state's overall revenue, which can further reduce taxpayer burdens while benefiting a variety of institutions including public schools, universities, and hospitals.

Information compiled based on an interview with Stephanie Garcia Richard and Craig Johnson, commissioner and co-commissioner of the New Mexico State Land Office, conducted by National Renewable Energy Laboratory (NREL) staff Matthew Kotarbinski and Amy Sedlak, June 25, 2019.

Regardless of the tax mechanism, governments might issue rebates to residents in areas that have wind energy projects, but this depends highly on state and local policy regarding revenue limitations. One example of local rebates is Sherman County, Oregon, which is home to multiple wind energy projects. The county uses various tax-based revenue structures, including SIPs, to collect revenue from these developments. For the past 12 years, each resident of Sherman County has received a portion of wind energy revenue in the form of an annual payment of almost $600. The county states that the purpose of the program is "to encourage and promote residency in Sherman County which will, in turn, facilitate economic development and stability."

Rural communities can have limited temporary housing and might be burdened during the construction phase of a wind energy project when there is a high influx of workers, resulting in housing stock shortages. To take advantage of the increased economic activity and remedy any shortages of housing availability, some counties have been using revenue from wind energy to address local housing concerns. Increased housing stock can have benefits to the community once the wind project construction is complete by providing additional housing options for residents or people moving into the community.

To support the additional influx of workers during the construction phase of the various wind developments, decision makers in Sherman County, Oregon, worked with wind energy developers to expand available housing options. The county used its local economic development organization to improve infrastructure that would support an increased workforce in the region. During the development of the Golden Hills Wind Project, Avangrid Renewables agreed to provide Sherman County with $100,000 per year to increase housing stock in the area.

Information compiled based on an interview with Tom McCoy, commissioner of Sherman County, conducted by NREL staff Matthew Kotarbinski, Amy Sedlak, and Jeremy Stefek, July 10, 2019.

Similarly, Morrow County, Oregon, experienced a housing shortage because of an influx of workers for various projects occurring simultaneously, including the construction of wind energy projects and the development of other tech-based endeavors. To remedy this issue, Morrow County used the revenue it collected from various SIP agreements to expand housing options.

Information compiled based on an interview with Carla McLane, planning director of Morrow County, conducted by NREL staff Matthew Kotarbinski and Amy Sedlak, July 18, 2019.

In some instances, counties can save wind energy revenue to supplement department budgets during future economic downturns. For example, Elbert County, Colorado, collected approximately $4.2 million in building permit fees during the development phase of a 600-MW wind energy project. County commissioners decided to retain approximately $500,000 of the building permit fees in a contingency fund that can be used for catastrophic or emergency events. In addition, the commissioners created a stabilization fund, using approximately $3.2 million of the fees. This stabilization fund should allow the county to maintain normal operations and staffing levels during an economic downtown. This highlights an important theme for many rural communities in Colorado: the importance of planning ahead and creating funding mechanisms to support long-term sustainability options.

Although some states and counties might provide tax exemptions to incentivize local wind energy development, some stakeholders have expressed concern that these agreements reduce revenue that could otherwise support local communities. For example, prior to 2017, Kansas offered a lifetime local property tax exemption for wind energy projects located in the state. As part of SB 91, the state replaced the lifetime exemption with a 10-year exemption. In December 2017, it was estimated that this lifetime exemption resulted in the loss of $82 million per year that would have been generated for all 24 Kansas counties with wind energy projects in their communities. Further, it was estimated that approximately $32 million per year of this money would have been allocated to the rural school districts in the state.

Timeline

This process timeline illustrates how local governments are impacted by the various stages of wind energy development. Because timing can vary widely depending on location, project type, and other factors, the timeline is meant to illustrate the relative order of events and does not include specific guidance on how long certain steps may take.

Community Development Information

Ask WINDExchange

If you have wind energy questions related to economic development in your community, please contact WINDExchange. We will connect you with an expert who can respond to your questions.

Additional Resources

- A Rocky Mountain Institute report highlights three case studies to share how rural America is reaping economic development benefits from the growth of renewables.

- Case studies developed by the Center for Rural Affairs highlight how peer communities are using wind energy revenue and may prove useful for local decision makers from states in the Midwest and Great Plains regions.

Landowners and Development Considerations

Overview

Whether through crop production, grazing, or other agricultural activities, many rural landowners are accustomed to using property to generate income. Wind energy offers landowners an additional form of revenue that can diversify income for farms and ranches, which can be impacted by fluctuating markets and weather conditions. In addition, the payments are often received on an annual basis, providing a more secure, steady source of income. The land surrounding a wind energy project can continue to be used to raise cattle, grow crops, or for other agricultural purposes. Additionally, the increase in local income can allow farmers and ranchers to invest in the farm or ranch by purchasing local good and services, which supports an increase in economic development in the community.

This section focuses on landowner compensation topics, including:

- Option agreements. A preconstruction landowner agreement that allows project developers to secure short-term rights to assess the wind resource prior to project construction

- Types of landowners. Describes the different property owners (individual and government) and the ways in which they can host aspects of a wind project (turbine, project infrastructure)

- Land lease compensation. Focuses on the revenue structures, average payments, regional differences, and other factors that might affect landowner compensation

- Impacts during construction. Highlights the importance of landowner and developer communication as well as compensation for crop damage during wind energy project construction

- Sustaining Rural Landowners. Provides an understanding of how wind energy revenue has been used by landowners to support continued long-term agricultural use.

The Additional Resources section offers information to support landowners who are navigating the land lease or easement contracting process. Landowners should be as informed as possible about a wind energy project and are often represented by legal counsel while negotiating with project developers, especially because the contract commitment is typically 20–30 years, often with an option to renew.

Timeline

This process timeline illustrates how local governments are impacted by the various stages of wind energy project development. Because timing can vary widely depending on location, project type, and other factors, the timeline is meant to illustrate the relative order of events and does not include specific guidance on how long certain steps may take.

Landowners and Development Considerations

Option Agreements

An option agreement allows a wind energy project developer to determine a project's viability during a short term, providing the developer time to complete activities such as a wind resource assessment, permit approvals, and project design before signing a long-term wind energy development contract. By signing an option agreement, landowners typically receive compensation from a developer in exchange for the option to construct a wind energy project if it is considered a viable project.

The payment structures featured in an option agreement can vary depending on the terms negotiated between a landowner and a wind energy project developer. Differences in these payment structures can include the length of time for the contract, the total dollar amount per acre, and whether that dollar amount is fixed or increases during the length of the contract. An option agreement could last several years before the wind energy project is constructed and typically specifies the terms and conditions under which a project developer will or will not execute their option to develop a wind energy project in the area.

When a developer signs an option agreement with a landowner and the project layout and design plans are still being finalized, the land lease contract participants may change during the option period as the developer completes the wind energy project design. If a developer decides to execute their option on a particular property, they will have to negotiate an additional ong-term lease agreement with the landowner.

For example, a developer approaches a landowner in 2020 and agrees to pay a landowner $5 per acre each year while the developer plans the wind energy project and secures additional land. In 2023, the developer decides to build the wind energy project and executes their option on the land. The developer then signs a long-term lease agreement, which includes an annual payment to the participating landowner. Details on this annual payment are summarized in the Land Lease Compensation section.

Types of Landowners

Landowner compensation payments are negotiated between property owners (including state, federal, or local agencies, if the land is publicly owned) and a project developer as part of a larger wind energy development contract.

These long-term contracts are often complex and cover property leasing or easement, contract duration, liability issues, payment details, tax considerations, land impact considerations, and decommissioning. Many landowners choose to negotiate independently with the wind energy project developer, but there are several examples of landowners forming an association to combine resources during negotiations.

The number of participating landowners depends largely on the size of the project, the available land, the local wind resource, and other siting elements that project developers use to determine developable locations for the individual turbines that comprise a wind energy project. Although wind turbine hosts receive the greatest portion of landowner compensation, individuals who host project infrastructure are also compensated. Types of landowners who might be engaged by developers include:

Property owners with suitable land to host a wind turbine and sign a lease or easement contract with a project developer. A participating landowner will receive payments as specified under the agreement for each wind turbine installed on their land.

Property owners with suitable land to host infrastructure such as transmission lines, substations, roads, facilities, and other ancillary wind energy project components. A participating landowner will receive payments as specified under the agreement for the type of infrastructure installed on their land.

Property owners who do not have a wind turbine installed on their property might need to sign a contract to provide access to wind turbines via roads, ensure there are no obstacles prohibiting access to the wind, or address any concerns associated with installing a wind turbine near their property. Adjacent property owners can receive compensation but typically at a value less than participating owners.

Property owners who do not have a wind turbine or other project infrastructure installed on their property. Nonparticipating landowners may or may not be in the viewshed of a wind turbine. These landowners do not sign a wind energy development contract and do not receive compensation.

A wind energy project might be sited on land owned by companies, investors, foreign firms, land trusts, or the actual wind energy project operator, rather than being owned by an individual or family living in a community. These corporate entities might also receive land lease compensation from the project developer, but the revenue is less likely to provide rural and community benefits.

Project developers must negotiate with federal or state agencies to secure land rights for any wind energy projects that are developed on public lands. The U.S. Bureau of Land Management—which has approved 35 projects totaling more than 3,000 megawatts (MW)—has leasing regulations that dictate the rent and fees for wind energy project development on public lands that they manage. Wind energy projects can also be constructed on state lands. Each state has its own agency that controls the process for these developments. For instance, the New Mexico State Land Office's Office of Renewable Energy is tasked with managing renewable energy development on nearly 9 million acres of land that are available for lease to renewable energy companies.

Land Lease Compensation

Project developers negotiate payment terms with landowners to secure the land rights that are needed to develop a wind energy project. The American Wind Energy Association, now American Clean Power, estimated in 2019 that the wind industry pays $706 million annually in landowner lease payments. The average land lease payment across the United States is $6,700 per megawatt (MW), based on total revenue data from American Clean Power on a per-megawatt basis and supplemented with wind energy project data from a literature review of news articles and press releases.

Landowner payment terms and amounts vary based on agreement negotiations but are generated at properties across the United States. Source: U.S. Wind Turbine Database, American Clean Power, 2019.

Land lease agreement payments are typically structured in one of three ways: fixed payments, revenue-based payments, or a combination. Project developers might prefer to negotiate a certain payment structure with landowners based on the economic considerations of a particular wind energy project. Landowner compensation can vary among individual projects and landowners in a single project could have different agreed-upon terms.

An annual payment based on a per-turbine or a per-megawatt basis. On a per-turbine basis, the contract language might state that a landowner is paid $7,000 annually per wind turbine installed on their land. On a per-megawatt basis, if there is a 2-MW wind turbine and the contract states $3,500 per megawatt, the landowner would receive $7,000 annually.

A percentage-based payment that depends on the annual income a developer receives from selling the energy generated by any project-related wind turbines located on a landowner's property. The lease agreement should clearly define the percentage a landowner receives and how generation is calculated. Depending on the contract specifics, this overall percentage can increase during the agreement lifetime. Additionally, the amount of energy generated at a given location can vary from year to year depending on wind speeds and wind turbine curtailment, which can impact the overall amount of these payments.

A payment structure that features aspects of fixed payments and revenue-based payments. There are two primary ways to combine these structures:

- An option for the landowner to receive either a fixed payment or a revenue-based payment, whichever is higher.

- A fixed base payment plus an additional revenue-based payment.

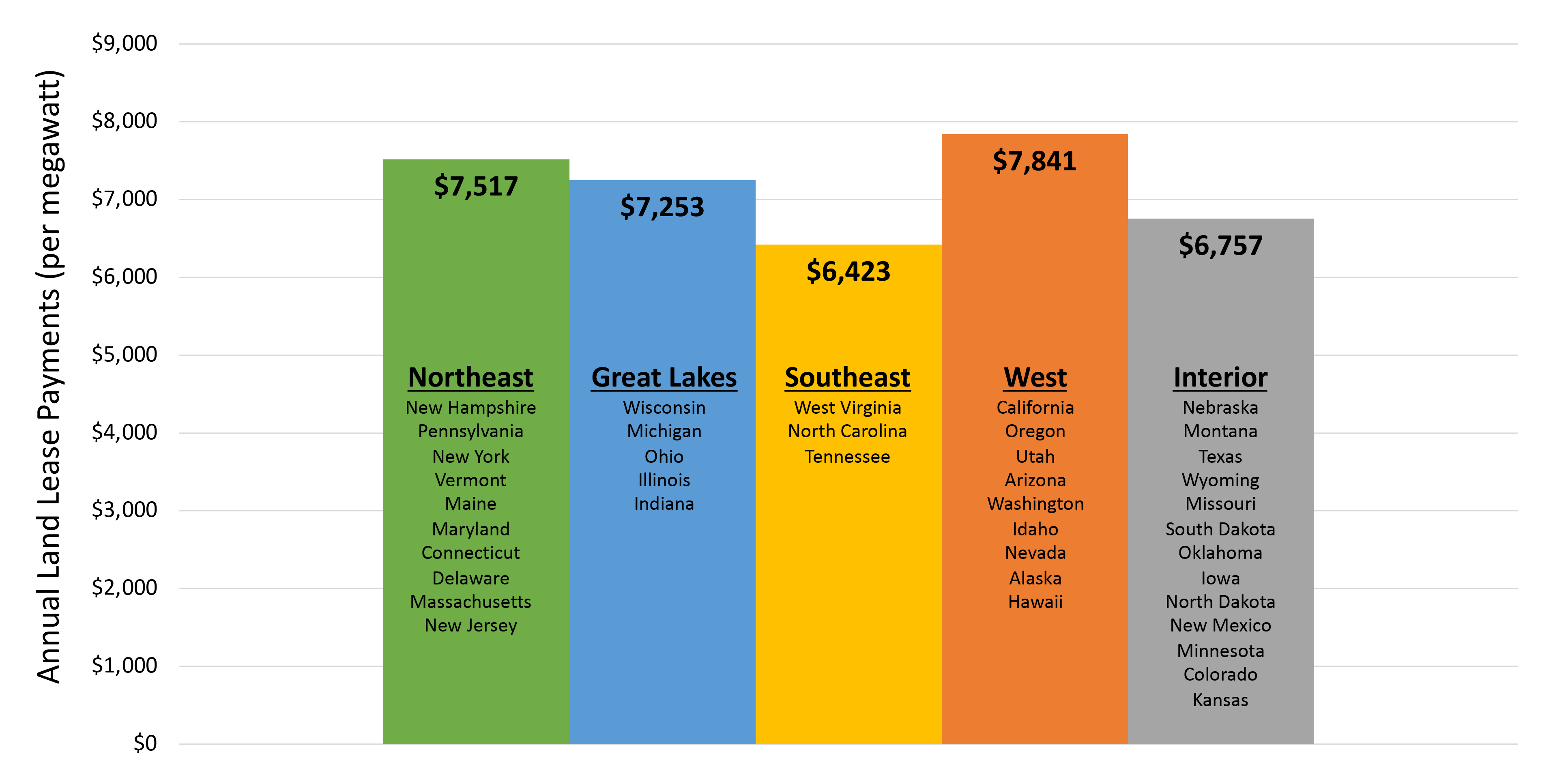

In addition to differing structures, lease payments can vary from one location to another. This chart shows the regional differences in average landowner lease payments in the United States.

Regional Differences in Landowner Compensation

The differences in per-megawatt landowner lease compensation can vary among U.S. regions. Source: Chart was created from data from the American Wind Energy Association and downloaded wind energy project capacity across a state level from the U.S. Wind Turbine Database to determine an average payment, 2019.

A variety of factors can influence the total amount a specific landowner will receive for hosting a wind turbine or any project-related infrastructure, resulting in compensation differences at the regional, local, and project levels. These factors include:

- Amount of available and developable land

- Strength of the local wind resource

- Land value

- Current land use

- Potential for future development (commercial, residential, recreational)

- Wind turbine size

- Access to transmission

- Price of energy established in an offtake agreement

- Actual generation per turbine on property

- Energy demand (to meet renewable energy goals and consumer needs)

- Ability for landowners to negotiate or to have others negotiate on their behalf

- Competition among developers or projects

- Business practices of the developer.

Impacts During Construction

Participating landowners and the wind energy project developer should initiate conversations to understand how project construction and operation could affect the agricultural uses of their property. Although agricultural activities can continue on a significant portion of land throughout the construction process, some areas will be temporarily disrupted while construction activities occur, increasing the need for landowner and developer communication. After construction is complete, only a small portion of the land is typically impacted by the wind turbine and roads.